Doppelbesteuerung am Beispiel der Schweiz

Wie Sie in der nebenstehenden Darstellung sehen können, geht es um bares Geld. Im Beispiel können 20 % der Bruttodividende aus der Schweiz zurückerstattet werden.

Die Kalkulation des rückforderbaren Betrags ist im Divizend Maximizer für Sie übrigens immer kostenlos. Unser transparentes Preismodell garantiert dabei, dass für Sie am Ende immer ein Plus stehen bleibt.

Berechnen Sie jetzt Ihren Rückerstattungsanspruch.Wir unterstützen derzeit die folgenden Länder für die Rückerstattung ausländischer Quellensteuern. Aus welchen der folgenden Länder besitzen Sie Aktien, die Dividenden ausschütten? Achten Sie darauf, dass Sie nicht das Land auswählen, in dem Sie selbst steuerlich ansässig sind.

...Sie hätten im Jahr 1960 10.000 CHF in Nestlé-Aktien investiert.

Damit hätten Sie aus heutiger Sicht bereits vieles richtig gemacht.

Abhängig davon, wie Sie über die Jahre hinweg mit Ihren Dividenden umgegangen sind und ob Sie die Schweizer Quellensteuer rückerstattet hätten oder nicht, könnte der Wert Ihrer Aktien heute zwischen 743.000 CHF und 3.410.000 CHF liegen.

Aber wie schaffe ich es, das Maximale rauszuholen?90 Sekunden clever investiert.

Unser Video zeigt Ihnen in 90 Sekunden auf anschauliche Art und Weise, warum Quellensteuern auf ausländische Dividendenerträge ein bedeutendes Thema sind und wie unsere Plattform Ihnen dabei hilft, sich dieses Geld von ausländischen Steuerbehörden zurückzuholen. So können Sie Ihre Erträge ganz einfach maximieren, was deutlich zu Ihrem langfristigen Anlageerfolg beiträgt.

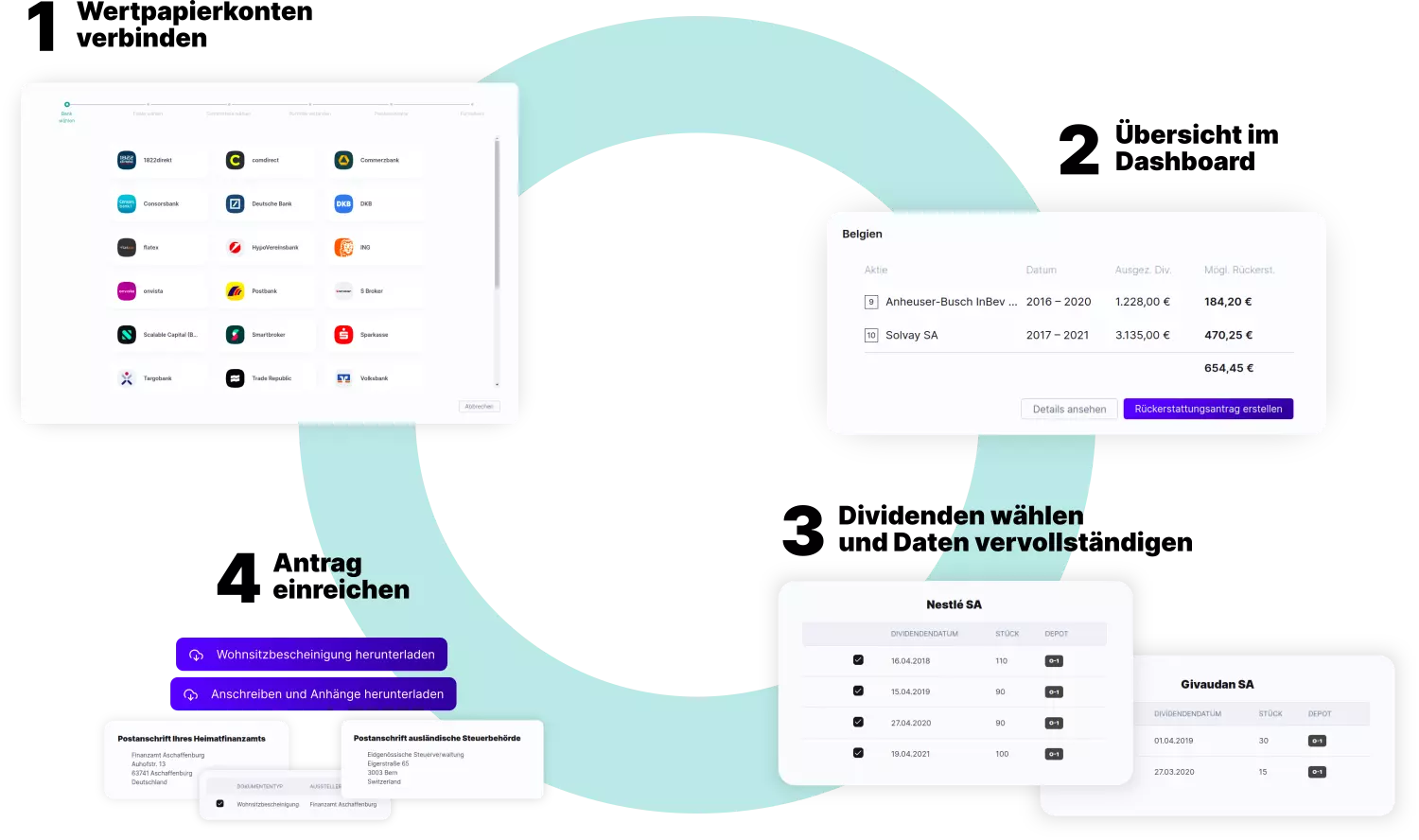

Erfahren Sie, wie es in der Praxis funktioniert.

Der Maximizer ist die revolutionäre Lösung von Divizend für die geführte, leicht verständliche Einreichung von Quellensteuerrückforderungen für private und institutionelle Anleger, eingebettet in das einheitliche Divizend-Ökosystem. Erhalten Sie einen schnellen Einblick in die Plattform und ihre Funktionsweise.

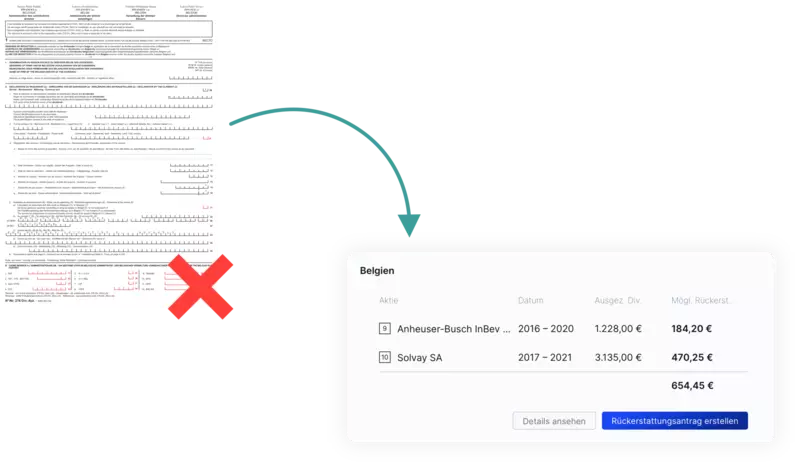

Keine komplizierten Antragsverfahren mehr

Die Antragsformulare sind von Land zu Land sehr unterschiedlich und durch die Verwendung steuerlicher Fachbegriffe kaum zu verstehen. Das macht es schwierig, die Rückerstattung schnell und problemlos durchzuführen.

Ihre Vorteile mit Divizend

einheitlicher Prozess, gleiches Look-and-Feel für alle Rückerstattungsländer

fehlerfreie Anträge durch automatische Validierung, Depotimport und Vorbefüllung

einfache Schritt-für-Schritt Anleitungen

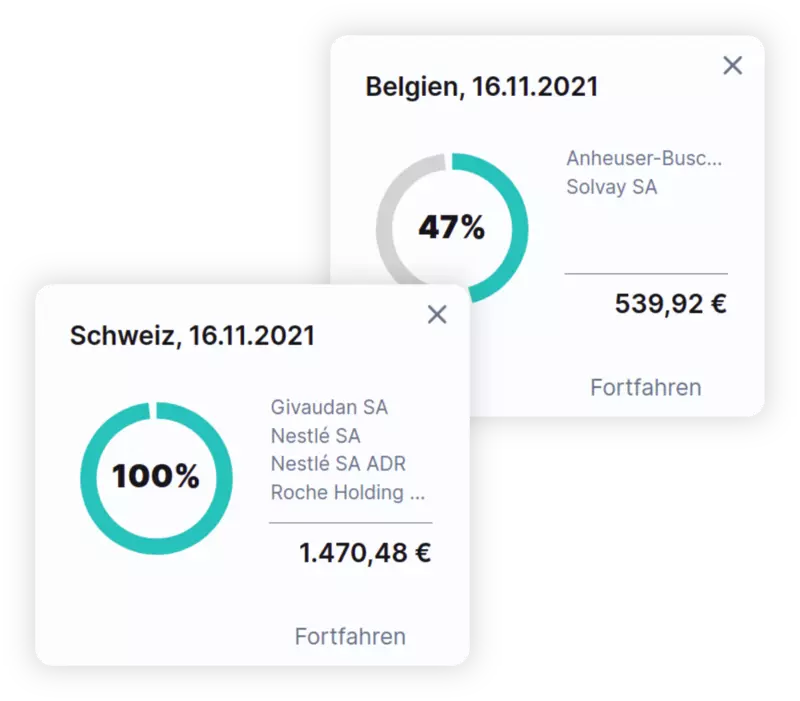

Rentables Rückerstattungsverfahren

Traditionelle Steuerrückerstattungen können zu einem erheblichen Zeit- und Kostenfaktor für Sie werden. Gleichzeitig ist es nicht einfach, im Voraus zu wissen, ob sich die Mühe überhaupt lohnt.

Mit Divizend schließen Sie dieses Risiko aus und haben im Voraus höchste Transparenz über die Höhe Ihrer Rückerstattungen.

Zeit ist Geld

Auf dem traditionellen Weg ist es für Sie schwierig, den Überblick zu behalten, da sich die Rückerstattungsverfahren über mehrere Wochen, Monate oder sogar Jahre erstrecken können.

Wir nutzen, falls verfügbar, digitale Schnittstellen, damit Sie Ihre Anträge mit nur einem Klick einreichen können. Mit uns haben Sie einen langfristigen und zuverlässigen Partner an Ihrer Seite, der Sie immer auf dem neuesten Stand hält und Sie gleichzeitig zuverlässig an Fristen erinnert.

Kurz gesagt – für alle!

Alle, die Dividenden aus dem Ausland erhalten und sich die zu viel gezahlte Quellensteuer kostengünstig rückerstatten möchten, finden in Divizend den richtigen Partner. Welche zusätzlichen Vorteile Sie erwarten und wie Sie Kontakt mit uns aufnehmen können, erfahren Sie durch einen Klick auf Ihre Zielgruppen-Kategorie.